Industrial IoT and LPWA connectivity – future proofing industrial IoT

Industrial OEMs, distributors, and customers face a challenging question: how do I capture value from IoT today while avoiding a costly overhaul tomorrow? Invest too early, and rapid changes in connectivity technology will leave most IT departments under water. Invest too late, and the competition will undercut you as they find innovative ways to reduce cost.

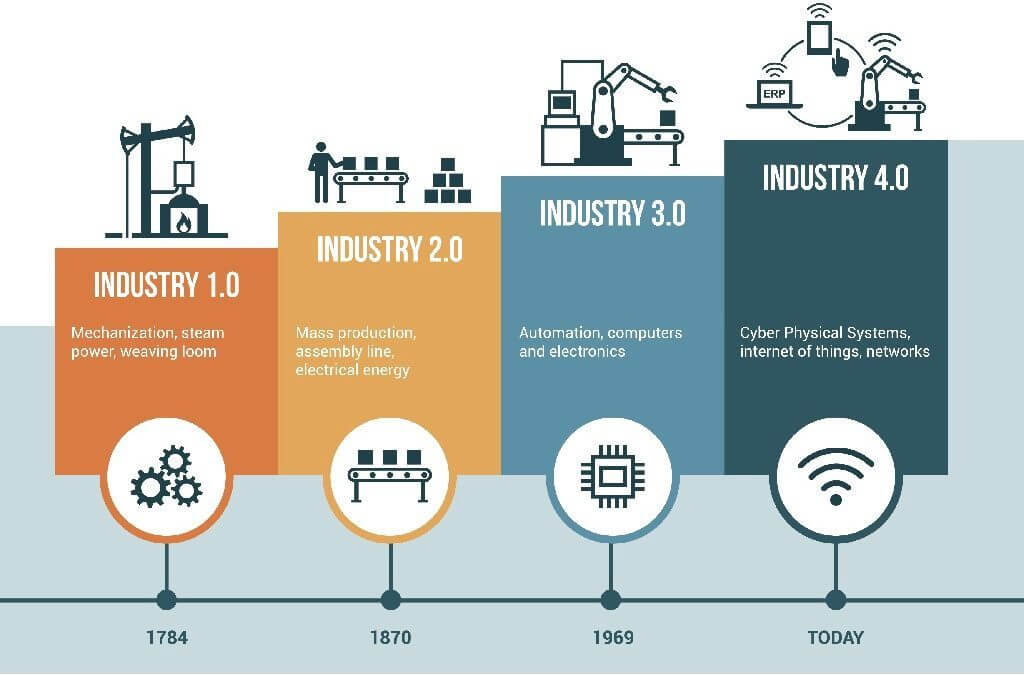

At Xemelgo, we believe now is the time to embark on the journey to Industry 4.0, and we’ve partnered with Soracom to bring your assets best-in-class connectivity and prevent headaches during implementation.

However, we also know that OT sales cycles are long and opportunities to inject new tech are few and far between. The only convincing strategy is one with longevity built in. To close out this series, let’s dive into how cellular LPWANs and virtual network operators can help mitigate uncertainty in the Industrial IoT.

Cellular LPWANs

Low-power, wide-area networks (LPWANs) that operate on the licensed RF spectrum are a group of related connectivity technologies that all conform to the same general standards. They emerged thanks to heavy investment from mobile carriers to accommodate the explosion of sensor data from low-power devices in expansive or hard-to-reach coverage areas. Think hundreds of shipping containers across a port, or hygrometers in remote deserts.

LPWA technology is designed specifically for industrial use cases. In fact, AT&T rolled out their LTE-M network (the LPWA counterpart to the same connectivity we have on our mobile devices) with almost exclusively industrial partners:

- Smart water meters with Capstone Metering

- Shipping container monitoring with Xirgo Technologies

- Connected vehicles and fleet & asset management with CalAmp

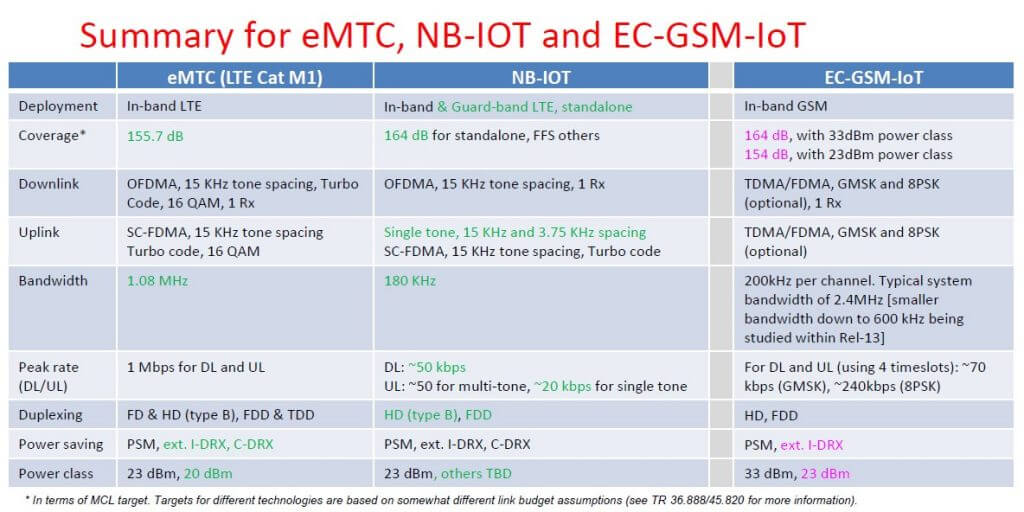

3GPP, the standards-setting body for telecom, has specifications for three cellular LPWANs: LTE-M, NB-IoT, and EC-GSM-IoT. That’s a lot of acronyms, but at a high level, all three are low-power wide-area networks expected to support hundreds of millions of connected devices using existing cellular infrastructure. Each device in these networks will:

- consume small amounts of power — a single 5V battery should last 10 years

- send small amounts of data over long distances — up to 10km away from a base station

- improve gain over legacy systems by +20dB — signals can penetrate subsurfaces or other hard-to-reach places often found in industrial environments

As the hardware market continues to evolve, the price point for these devices is predicted to come in at~$6 ($5 for the hardware and $1 in recurring subscription cost).

Longevity

LPWANs are considered relatively future-proof because mobile network operators have already invested heavily to ensure these technologies (with the exception of NB-IoT) are backwards compatible. Currently, all that’s required for existing devices to support LTE-M or EC-GSM-IoT is an over-the-air update at the base station or device itself, which can be administered remotely. For many OEMs and distributors, an off the shelf, LTE-enabled device with 10 years of battery life and remote maintenance is exactly the type of safe investment required to take the plunge.

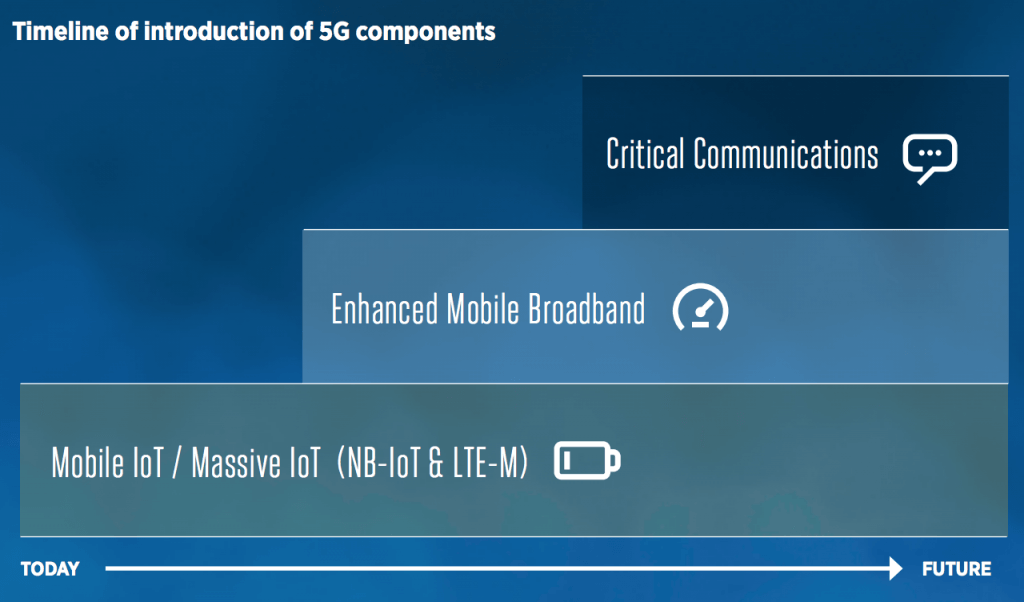

Looking forward, even major evolutions like 5G will not break existing cellular LPWA modules, as 3GPP has rolled both LTE-M and NB-IoT into 5G deployment standards.

NB-IoT and LTE-M network components already operational today will continue to do so and eventually coexist as other 5G NR components, e.g. enhanced mobile broadband and critical communications, are deployed in the same networks at a later point in time. — GSMA

https://www.gsma.com/iot/wp-content/uploads/2018/05/GSMAIoT_MobileIoT_5G_Future_May2018.pdf

A further proof point for longevity is in the rollout of LPWA devices. These are often embedded modules that link directly to base stations or towers to remove reliance on (or maintenance of) gateways or other relay hardware.

Likewise, maintenance of security protocols like HTTPS, secure socket, secure boot, or firmware OTA updates is “outsourced” to mobile network carriers that invest heavily to prevent security breaches. Avoiding overhead on IT networks and devices is increasingly important as it allows operators and technicians to focus on managing the truly critical assets.

Partner with an MVNO

A key component to future-proofing any sort of cellular Industrial IoT strategy is partnering with the right mobile virtual network operator (MVNO). An MVNO leases spectrum from traditional mobile network carriers and often works with several carriers in each region. As an end customer, this not only prevents vendor lock-in, but also provides a strategic buffer in worst-case scenarios, like if a certain technology is completely sunset.

For example, last year signaled the end of AT&T’s official support for 2G connectivity in the US, leaving 6 million devices (the majority of them M2M) stranded. Owners of those devices could either upgrade the hardware of each individual unit to support 3G or LTE at ~200$/unit, or switch their entire network over to another vendor like T-Mobile. For some this was a bitter reminder that what is bleeding-edge today is obsolete tomorrow.

Only a few companies were able to avoid this altogether by working with an MVNO. A virtual network operator can leverage the capabilities of multiple networks, such that your operation continues without a hitch — even with radical changes in the underlying standard or technology. Outsourcing device management while still gathering the data and insight off the sensors can help justify the cost of a multi-year implementation.

http://www.securityinfowatch.com/article/12152340/2016-the-year-of-the-2g-sunset

Another long-term benefit to selecting the right MVNO is that, unlike mobile network carriers, they are not solely dependent on licensed spectrum technology. With the rise of non-cellular LPWANs, like Sigfox and LoRaWAN, hybrid solutions are starting to hit the market that alternate between sending data through licensed and un-licensed RF spectrum. Working with an MVNO like Soracom allows industrial customers to stay on top of emerging IT trends without disrupting their OT process each time a new product is released.

…

At Xemelgo we understand it’s not enough that assets are connected reliably and securely. Any injection of new technology into an OT process has to account for the extended development cycles inherent to the industry. By choosing cellular connectivity and the right MVNO, industrial OEMs, distributors, and customers can capture value from Industry 4.0 with confidence.