Combining FinTech IoT and Cloud – the future of banking

Mizuho’s R&D for Secure IoT Payments Platform

Mizuho Financial Group, Inc. announced R&D for a Secure IoT Payments Platform using SORACOM on Jan 25th, 2017.

…

Recently I saw news about MUFG (“Mitsubishi UFJ Financial Group”) announcing to move into the cloud. It seems that the two of three mega-banks in Japan are making their move in the direction of Fintech.

I am no stranger to their on-premises systems. In fact, I am partially responsible for some of their global system designs and implementations. My past decade (including some weekends) were dedicated for implementing such enterprise “legacy” systems (and some newer-legacy systems).

They are built for stability, not for flexibility. With ever-changing regulatory compliance, these systems received countless “bandage fixes” on top of another, resulting very high maintenance cost for any further changes.

Cloud computing offers the best path forward to untangle, hugely complex, intricately intertwined, aging banking systems that most financial services firms currently operate on globally.

Going Cloud will be a “must have” preparation for the upcoming fundamental architecture changes that we are seeing some of the next wave of disruptive technologies — at the conjunction of FinTech, IoT and Cloud.

Thank you,

Tack T.

Disclaimer: This blog entry does not represent the thoughts, intentions, plans or strategies of my employer. It is solely my opinion.

…

[FinTech]Start of Research and Development for the Creation of an IoT Payments Platform

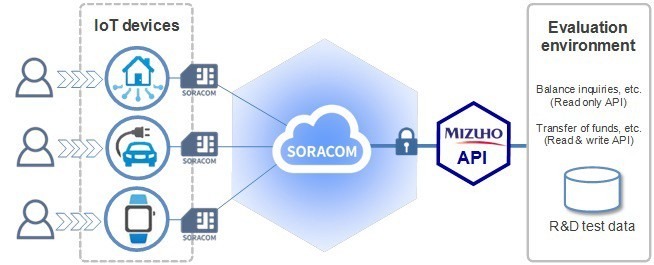

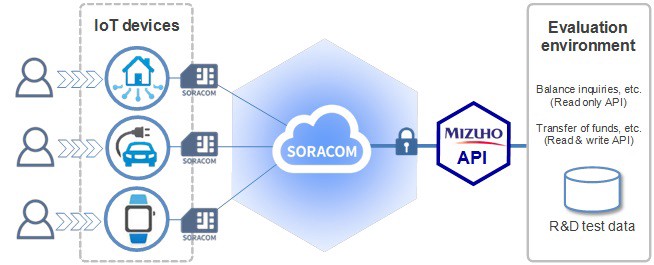

Mizuho Financial Group, Inc. (President & Group CEO: Yasuhiro Sato) is pleased to announce that we have begun research and development for the creation of a platform for secure payments using IoT devices (smart home devices, connected cars, wearables, etc.).

As cloud–based services become more widespread and communication modules become more affordable, the various “things” that we interact with in our daily lives are increasingly becoming connected to online networks and this is increasingly impacting our lifestyle. The services provided by banks are also changing to offer customers more convenience, with a shift from bank branches to ATMs, online banking, mobile banking, and integration with third–party services via API(*1).

With consideration of these changes to the business environment, Mizuho will conduct research and development on using secure communications to connect IoT devices to the bank’s IT system (evaluation environment) to enable bank account access with the goal of providing safe and secure IoT payments using the latest technological innovations. We will work with SORACOM, Inc. on joint development using SIM cards(*2) connected to the SORACOM Air service and their IoT platform as the underlying technology.

Research and Development Platform for IoT Payments

As the first step of our trial utilizing IoT devices and an API, we will work with the “Liquid Regi” payment terminal with fingerprint sensors provided by Liquid, Inc. to enable bank transfers and balance inquiries literally with the touch of a finger (not requiring the use of a card or cash). The results of this trial will enable us to identify issues and potential applications for IoT device–based services utilizing banking APIs.

In addition to this project, Mizuho will continue to pursue a range of cross–industry open innovation through collaboration with the companies in residence at the Mizuho Creation Studio lab facility(*3) within Finolab, as well as through business matching events, and a variety of other opportunities.

*1) API

API is an acronym for Application Programming Interface. A banking API will enable a third party to interface with the bank’s IT system in order to access customer information and create/provide more diverse financial services. Third parties must be authorized to utilize the API by having in place the necessary information security controls and having received the appropriate permissions from the bank and the bank’s customers (depositors).

*2) SIM

SIM is an acronym for Subscriber Identity Module. It is a type of integrated circuit card (ICC) present in devices such as smartphones and IoT devices.

*3) Mizuho Creation Studio lab facility

The Mizuho Creation Studio has been established within the Fintech Center of Tokyo Finolab (commonly referred to as simply “Finolab”), which is jointly operated by Mitsubishi Estate Co., Ltd., Dentsu Inc., and Information Services International–Dentsu, Ltd., to create an environment for cultivating open innovation and coming up with ideas for new financial services. We plan for the Studio to be fully operational from February 1, 2017.

Source: Press Release

https://www.mizuho-fg.com/release/20170125release_eng.html